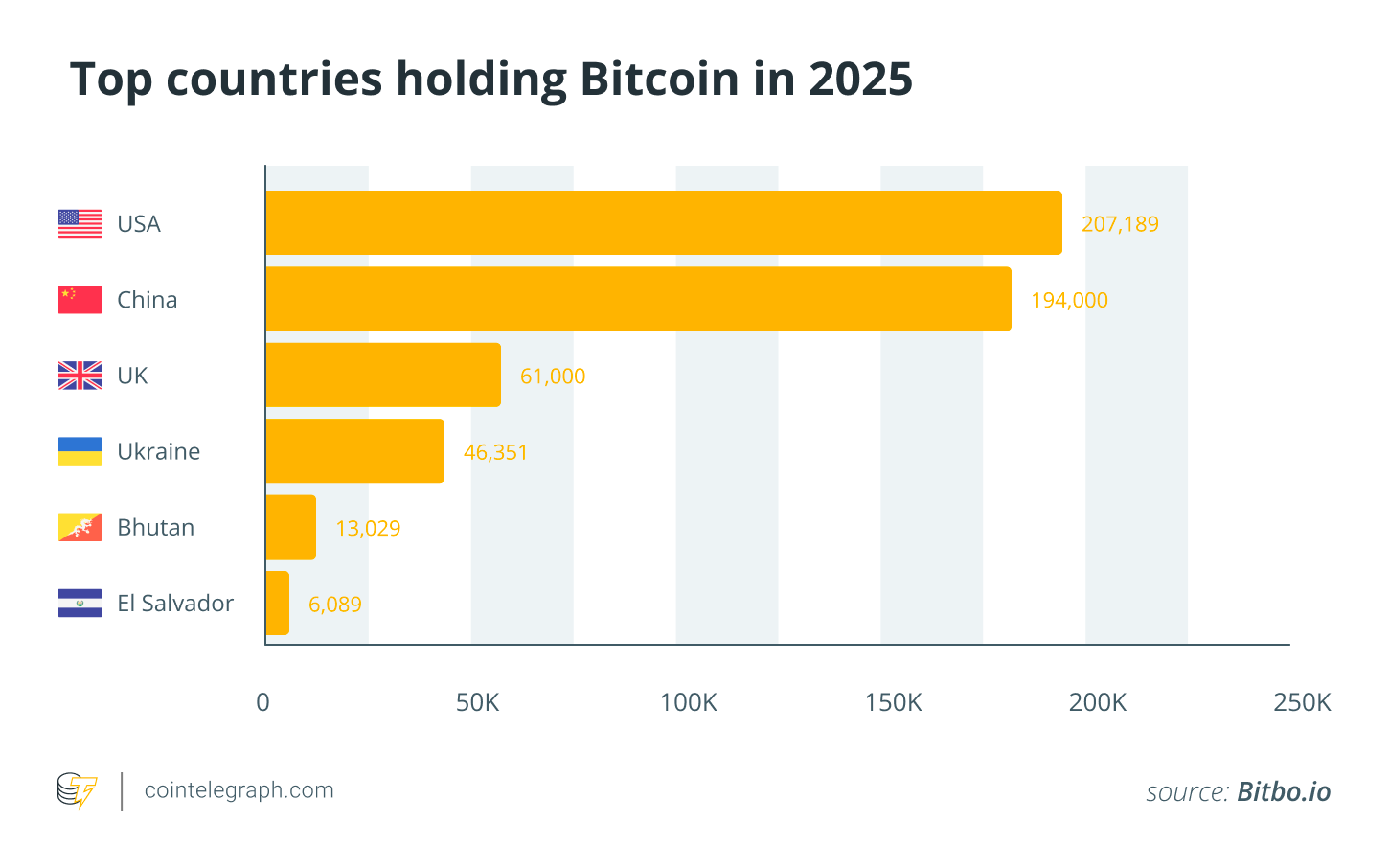

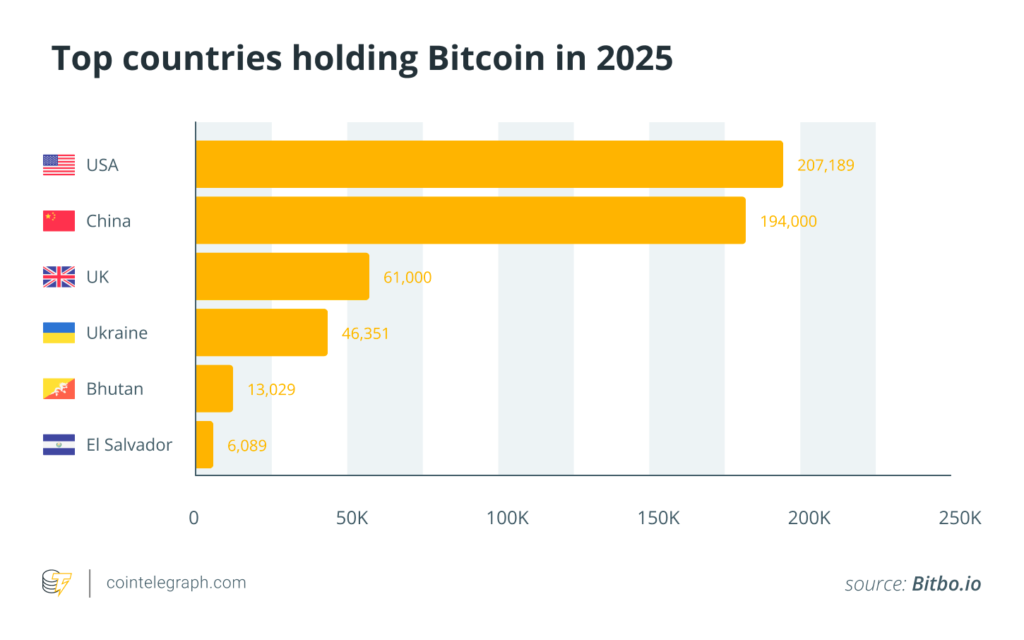

Roughly 463,000 BTC — or about 2.3% of Bitcoin’s total supply — is currently held by governments around the world, according to publicly available blockchain data and legal disclosures.

While that might sound like a small percentage, it equates to tens of billions of dollars in sovereign Bitcoin wealth, giving Bitcoin a growing role in national asset strategies and state-level accumulation.

Two countries dominate this list, and their positions are no secret.

The United States

The US government is by far the most visible player when it comes to Bitcoin holdings by governments. Through a series of high-profile seizures — ranging from the Silk Road marketplace to dark web operations and ransomware takedowns — it has accumulated nearly 200,000 BTC. As of early 2025, that stash is estimated to be worth between $18 billion and $22 billion, depending on market conditions.

But the US isn’t just holding these assets passively. In March 2025, President Donald Trump signed an executive order formalizing the creation of a Strategic Bitcoin Reserve, consolidating all seized BTC under federal control. Unlike previous administrations that auctioned off confiscated crypto, this signaled a new geopolitical mindset: Bitcoin isn’t just a forfeited asset — it’s part of the foreign government Bitcoin strategy.

China

Second on the Bitcoin ownership by country 2025 list is China, though its position is shrouded in opacity. In 2019, Chinese authorities shut down the PlusToken scam and confiscated over 190,000 BTC — one of the largest crypto seizures in history. But the fate of these funds remains largely unknown.

Some blockchain analysts suggest that parts of this holding were quietly liquidated. Others believe the coins are sitting dormant in government Bitcoin wallets, untouched in cold storage. Despite its ban on domestic trading and mining, China remains a key player in the geopolitics of Bitcoin ownership — perhaps one of the largest non-US Bitcoin reserve holders.

While the US and China dominate headlines, their stories are widely reported and routinely dissected by analysts and regulators.

What’s far less understood is the silent Bitcoin accumulation by countries outside of this duopoly. From Himalayan monarchies to debt-ridden democracies, a new group of nations is quietly reshaping the global Bitcoin ownership map.

Did you know? North Korea’s Lazarus Group held state-associated Bitcoin. The hacking outfit is believed to have amassed over 14,000 BTC before selling off more than $1 billion worth since March 2025.